Market Inefficiencies in crypto assets

by Marketing Team

There is no doubt that crypto-assets’ markets are reaching a great level of maturity, pushed by the market conditions that are leading towards digitalization. Besides, in a global market, holistic currencies that can not be manipulated in a centralized manner are becoming even more relevant —and resistant to economic crises-.

Nowadays, effective investment not only requires access to relevant information but also, the correct tools to manage information efficiently. However, the current offers of market infrastructure still seem to report some issues.

In order to succeed in these digitalized markets with high volume on demand, it is crucial to have the correct infrastructure, capable of delivering cross-functional market information to drive the best investment decisions.

This article aims to forecast the current state of crypto-asset markets, highlighting the shortcomings and potentials of them acknowledging the CoVid19-caused crisis. We overview the situation the investors are in, and the improvement possibilities to take advantage of the arising hedging assets offsetting the increasing world-wide hyperinflation.

The crypto-asset markets hedging against the global financial downturn

Bitcoin was on top until the coronavirus hit, its price nearly doubled in 2019 to around $6,500 by end of year despite dampened media coverage. Goldman Sachs named it the best-performing asset in 2019. Yet, since the coronavirus sell-off, BTC is down ~30% YTD.

Not a surprise, since all capital markets are being strongly affected by the economic downturn caused by the deflationary shock of the pandemic. As a consequence, Bitcoin has dipped below $6000 for the first time since May 2019. This selloff of cryptocurrencies also affected altcoins, so that for example the prices of Ethereum and Bitcoin SV dropped 30% and 40% respectively.

However, Bitcoin has made a comeback. As this article is being written, Bitcoin and the cryptocurrency market are on the rise again despite the global frenzy seen in the foreign exchange markets.

Bitcoin itself experienced a remarkable rebound – especially on the 19th and 20th of March 2020, with a top price of USD 6.682. Overall, Bitcoin lost about 110 Billion USD market cap from the peak it had before the corona crisis (from 190$b to $80b).

Figure 1: Bitcoin Price Chart in USD from April 2019 till April 2020 as of 09.04.2020, source: Coinbase.

While the European Central Bank (ECB) triggered its 750 Billion Euro stimulus package to respond to the corona crisis and several other central banks around the world started to follow, Bitcoin rebounded to $130b, gaining roughly 60% in market cap. The overall amount of Bitcoin is technically limited (around 18,3 million of currently 21 million Bitcoins are in existence as of April 2020), whereas the amount of fiat currencies is not. For this reason of limitation, some people see Bitcoin as “digital gold”

Although this does not represent a relevant correlation, certain market participants see Bitcoin as a crisis-currency, being a hedge against the inflation caused by cash-printing measures. Like a fire-proof hideaway for easily startled investors, Bitcoin has remained in the portfolio of many.

But this article will not revolve around Bitcoin, but rather around the proficiency of crypto-assets markets. More than ever, crypto-assets are showing how relevant digital markets are, thanks to the resilience and potential of its infrastructure to cope with pressing changes. That is why we are presenting a market overview, following the latest developments of the crypto-assets markets to understand how the future of capital markets will look like.

To start, we analyzed the microstructural patterns, closely analyzing the order books of several crypto exchanges on that aforementioned Friday (March 20).

During those days, we noted a slight decrease in the order acceptance from the exchange-side. Moreover, there was an unusual increase in Bid-Ask Spreads between 9 and 30 basis points, added to the quite interesting inter-exchange spreads for the spot markets:

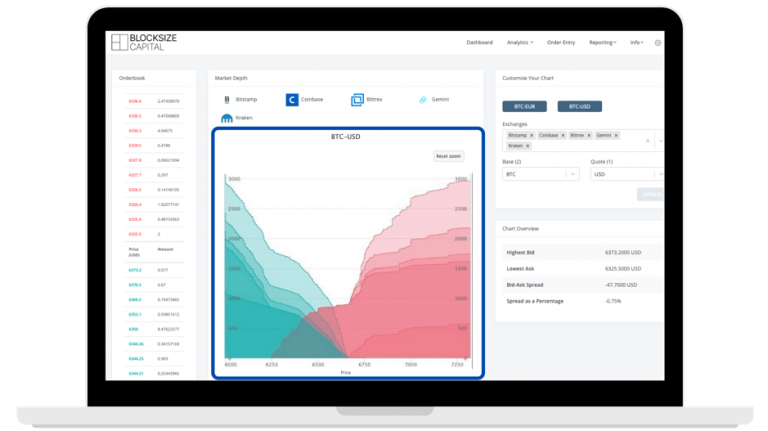

Regardless of the volume of Bitcoins being offered to sell, the demand was met by the markets and compensated by buy-ins. The generated overlap demonstrates that despite the downturn in the economic performance of regular capital markets, crypto-assets like Bitcoin remained stable. The overlap that can be seen in the figure reflects that the markets were not performing irrationally: nor were they buying at unusual lower prices nor selling at a critical point.

Hence, it is clear that, even during crises, crypto-assets markets retain a stability that can not be claimed by the regular financial markets. The potential is clear, especially after observing how some crypto-assets have shown a great ability to hedge stock market risk.

However, they are still some improvements to address, to build a professional market infrastructure that can be used and trusted by institutional investors. For this reason, we aim to deliver a strong value proposition to contribute to the progression of the crypto-assets market.

As a fintech company, we pride ourselves on discovering the technological gaps in the current financial infrastructure and supply the solution to those seeking an advantage over their competitors. Blocksize Capital has developed investment tools that delegate all tasks and challenges related to managing Digital Assets, ranging from trading and reporting to managing an entire portfolio for crypto-asset markets.

Services for Institutional Investors

To open these new asset classes (crypto and digital assets) to institutional investors, a new level of professional infrastructure is required. Such investors are more and more frequently racing to buy and sell cryptocurrencies, but only the ones with the best tools, data, and execution strategies are making the most of the market in times of both chaos and stability.

There are more than 200 different cryptocurrency exchanges that support active trading and each of them has different order books and the liquidity available which makes it extremely difficult for institutional investors to execute optimal trades. The current form of spreads of usually more than 100 basis points depending on currency pair are likely to squeeze the investors, even within highly liquid segments, discouraging market volume.

On top of this, every exchange has its APIs for retrieving market data and executing trades which deeply hinders software developers’ ability to create tools encompass the entire cryptocurrency market.

What traders need is a tool that can aggregate order books from all of these exchanges and calculate the liquidity and spread throughout the market. Besides, they need an easy to use method for executing trades based on the overall data. The services offered by Blocksize Capital enables our clients to do so.

Layered Order Books

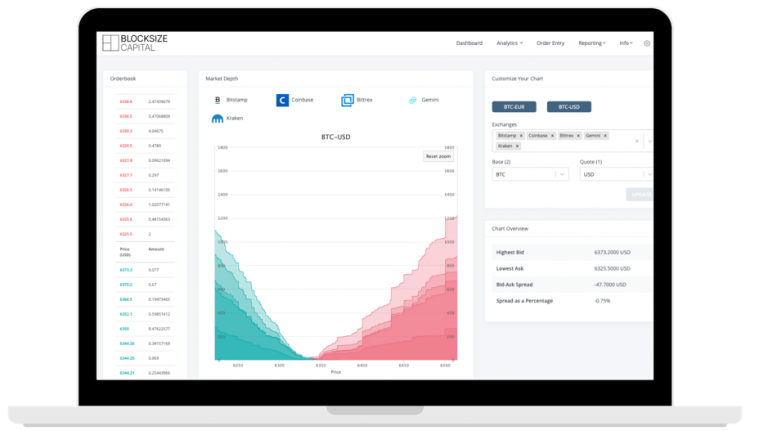

A real-time overview of exchanges that allows improving investment efficiency, by making informed choices with updated market information.

At Blocksize Capital we have connected to over 60 of the top cryptocurrency exchanges and do currently stream over 1 billion order book updates per day to provide this tool to our users. This feature allows any user to choose a selection of exchanges along with the trading pair they wish to aggregate. Our tool then generates a layered market depth chart displaying the liquidity of each selected exchange while calculating the spread on a second one-second interval.

We noticed very quickly that there are many opportunities to minimize spread when taking into account a holistic view of the cryptocurrency market and we even see many instances of negative spreads that indicate profitable opportunities for arbitrage traders and market makers. During this time of global crisis, we see even greater opportunities to take advantage of these spreads.

The following demo video of our tool gives a brief introduction to this innovative feature.

By loading the video, you agree to YouTube’s privacy policy.

Learn more

Smart Order Routing

The perfect tool for institutional traders that want to optimize their orders following the best prices in the market.

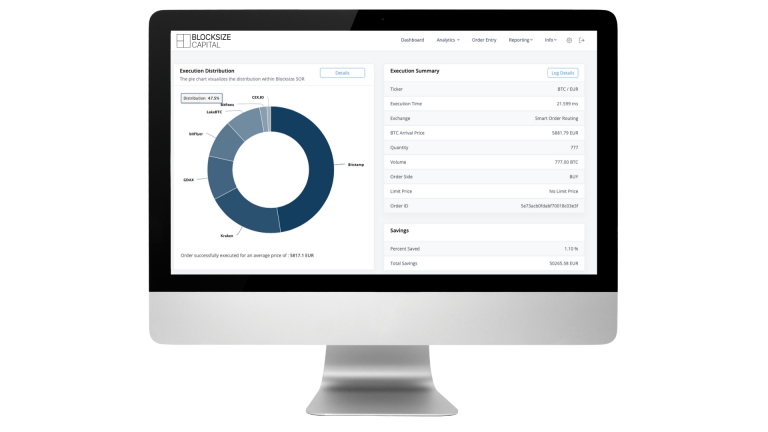

To further utilize this massive amount of order book data for institutional traders, we have built another tool called Smart Order Router. This Smart Order Router allows for the execution of a buy or sells order by comparing the best prices available throughout all of our connected exchanges with an easy to use interface (Blocksize Matrix) and API interface (Blocksize Core).

After an order is completed using our Smart Order Router, we can visualize the distribution of trades that were executed to the exchanges along with a summary comparing the execution price to the volume weight-adjusted price.

Thanks to these tools, investments become easy and efficient while being supported by accurate market information. In our ecosystem, institutional investors have real-time access to all the key figures needed to make the best investment decisions. We support effective investment by offering summary dashboards that compare and report about the market performance.

With Blocksize Capital’s tools, institutional investors don’t get blindsided with information asymmetry or overwhelm by numerous market insights, because all relevant knowledge is just one click away.

How to handle 1 billion order book updates per day on Blocksize CORE™

One of the most important features for investments is the order book and its updates describing the change of a single price level, triggered by the addition or removal of an order. While a high number of updates that happen on an order book do not necessarily indicate that high liquidity is available, it is a reflection of how active the trading is on a specific exchange.

When trading on an exchange, the trader is usually dealing against the publicly available order book. Therefore, the buy or sell decision-making process relies on an up-to-date order book. Any latency between the anticipated status and the actual status maintained by the crypto exchange increases the uncertainty with which the trader can predict the outcome of orders they have placed.

The commonly used crypto exchanges offer two ways of querying the current status of an order book. On the one hand, it is possible to request a one-time snapshot of the data, which is valid for a certain point in time. However, due to the volume restrictions that the exchanges have set up for queries, it is not possible to keep the order book up to date over a longer period using this procedure.

The resulting latencies may be acceptable for investors with small volumes or a long investment horizon but are not sufficient for all Blocksize Core customers, including particularly active day traders and Robo-traders. Therefore, Blocksize has decided to carry out all exchange connections in a latency-optimized manner.

The second option offered by the exchanges to receive order books is to subscribe to all incremental updates that take place in an order book. In this manner, the subscriber is automatically informed if the volume in the book at certain price changes, e.g. increases. This procedure reduces latency enormously but also places increased demands on the processing infrastructure.

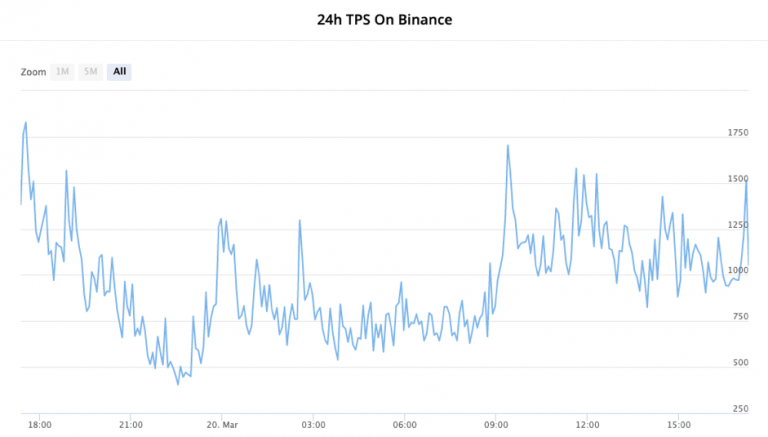

At peak times, more than 1000 of such updates take place per second, trading pair and exchange, which all have to be applied to the order book status held active in the system. Meanwhile, this status must also be retrievable with the least possible latency.

Since the incoming data volume in the middle of the day is about 100MB/s, we carried out extensive performance testing and settled for a Redis-based data management approach, in which multiple connections are established to each exchange, whereas the incoming updates are stored in a central, but horizontally scaled database cluster. This enables us to access order books within our systems with a latency of a few milliseconds.

That is why, thanks to our tools, the traders can avoid the effort and there with cost needed to connect multiple exchanges in a latency-minimized way, securing all market’s relevant information in real-time.

Improved investment for crypto-assets markets.

With the increasing interest in cryptocurrencies and assets, we anticipate a continuing rise in market activity, coupled with increasing latency-minimization requirements.

To cope with these demands, Blocksize Capital is already exploring ways to minimize these even more, by further optimizing our own market data infrastructure and by entering into co-location agreements with various crypto exchanges.

Having the interest of investors in mind, we aim to develop a one-stop portfolio-management and trading solution tailored for the use by institutional clients and asset managers. We’re offering a customizable trading frontend with the possibility to set up segregated sub-accounts and attach certain rights and limits to each of them, enforced by our system and managed by a chosen administrator.

In the current globalized capital markets, they are several pain-points that have been hindering investors, especially among crypto-asset markets. Our DLT- and Blockchain-based solution enable institutional investors to access the relevant market information in an efficient manner, with holistic overviews and aggregated data, allowing them to make smart decisions and follow-up arbitrage.

Our mission is to provide asset managers, family offices and institutional investors with the technical infrastructure to easily and efficiently manage Digital Assets. Blocksize Capital’s software solutions delegate all tasks and challenges related to managing Digital Assets, ranging from trading and reporting to managing an entire portfolio, to improve any investment potential.

If you are interested in boosting your trading potential, reach out.

Authors

Blocksize Capital’s team of experts:

Christoph Impekoven

Connor Payne

Friedemann Fürst

Luisa Blandón