Data with more utility

Access robust historic and real-time data to back-test your strategies, improve your returns through simulated trading and data-driven insights to execute quantitative low latency trading strategies. The BLOCKSIZE QUANT SDK is an open-source Python-wrapper integrating the features of BLOCKSIZE CORE and programmed to conduct high-performance quantitative trading.

With sophisticated data sets and aggregated market information, the BLOCKSIZE QUANT SDK brings clarity, efficiency, scalability, and cost savings to the entire investment lifecycle.

Market Data

Turn aggregated information and streamed data into a competitive advantage.

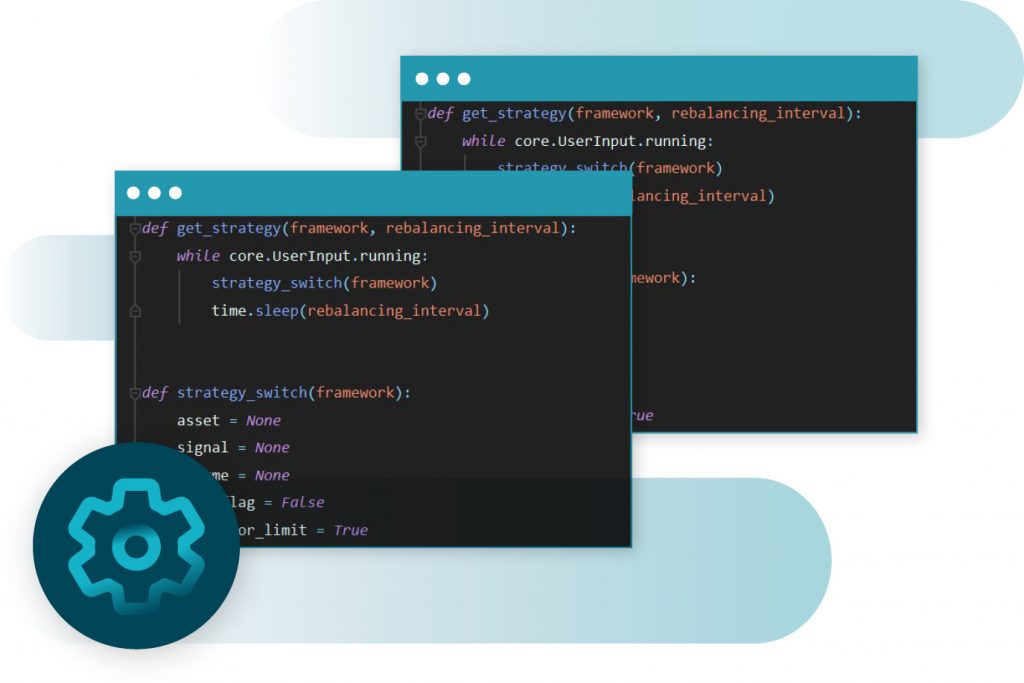

Backtesting

Enhance your positions by analyzing historical data to predict future market behaviour.

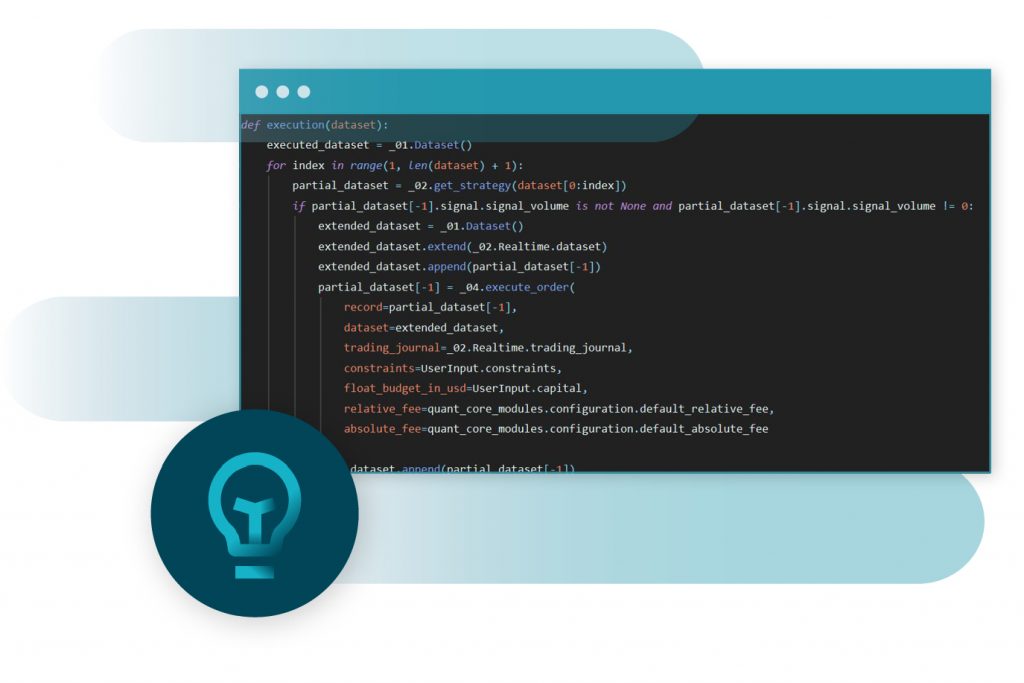

Trading

Improve your trading flows using a scientific approach.

Embrace the pulse of the market with the best trading method

PwC’s most recent market research established that quantitative crypto trading among institutional investors was one of the top-performing strategies in 2019 with an average 30% return. We are committed to connect digital assets and deliver our clients the best tools to increase their revenues.

The BLOCKSIZE QUANT SDK enhances rational and systematic strategies through scientific instruments, to automate trades and improve excess return. With this solution, institutional investors can analyze historical and real-time market data to create smart trading-logics while predicting future market behavior.

Quantitative Trading with smart market data

Turn aggregated information and streamed data into a competitive advantage. Thanks to the BLOCKSIZE QUANT SDK, our clients can create more efficient workflows, connect to the global crypto markets, drive high profitability, and lower their total cost of ownership.

- Take control of relevant market data to increase excess returns

- Execute sophisticated quantitative trading strategies

Backtesting – Scientific Analysis

The BLOCKSIZE QUANT SDK interface eases trading workflows with a scientific approach. We offer analytics-driven tools to route orders to a suite of destinations, empowering traders to optimize execution and drive down implicit costs.

- Project your position and create smart trading-logics

- Predict future market behavior with scientific market analysis