Ethereum and the Creation of Smart Contracts

by Dragan Djekov

In this article we are going to emphasize the significance of Ethereum and smart contracts when it comes to financial institutions, as well as the potential of Cryptocurrency lending in the future.

Smart contracts are programmable, self-executing contracts between two or more parties and exist in the form of computer-coded blockchain applications. The huge difference compared to contracts as we know them: there are no third parties involved, no paperwork is needed and if we think about a real-life contract situation, the first thing that comes to mind is trust based on personal relationships as well as compliance. Both of these factors are nearly irrelevant towards agreements based on smart contracts considering the blockchain-based infrastructure of DeFi. The Ethereum blockchain hereby serves as the smart contract platform, enabling projects in the cryptocurrency realm to make use of open protocols and decentralized applications (DApps).

Today we are going to take a closer look at why smart contracts are so essential and why they serve as the backbone of the blockchain operational motor, as well as how we can expect the majority of financial transactions to be based on smart contracts in the future.

In order to be able to provide a realistic outline on the future impact of Ethereum and smart contracts in the fintech space, we should begin with a breakdown of the Ethereum blockchain features and its structure including smart contracts.

Ethereum and its practical application through smart contracts

“Ethereum is an open-source, public, blockchain-based distributed ledger featuring smart contract (scripting) functionality. It enables developers to build blockchain applications with business logic that execute in a trustless environment, while leveraging the high availability of the Ethereum network.” ¹ The main difference compared to the structure of Bitcoin lies in the functionality. The Bitcoin blockchain can be used to perform transactions from one account to another, but blockchain technology in general and as of today offers a lot more functionality to implement.

With more and more Altcoins (alternatives to Bitcoin) being created and launched on the basis of blockchain technology, there were also various enhancements and developments made resulting in more functionality and ranges of application. In its core, there are a lot of similarities between the Bitcoin and Ethereum blockchain. After transactions are made, they are then sent to the blockchain and subsequently processed by miners. Despite those similarities, Ethereum has one main advantage since it was launched in 2013: The Ethereum blockchain, unlike the Bitcoin blockchain, has the ability to not only store information about transactions being made. Transactions made on the Ethereum blockchain have a “memory”, so that states can be read and changed over the course of several transactions. Depending on these states, the same transactions can then behave differently. In addition, the Ethereum platform also enables programming constructs such as loops. This technology hereby can be described as a programmable blockchain. Instead of enabling its users the application and usage of certain pre-assembled functions, the user should be able to create any function that is needed.

For instance, a transaction of money on the Ethereum blockchain can be conditional. The transaction will only be released, if the recipient has previously handed over a digital good beforehand. Otherwise, an automatic rollback takes place after a certain time and the sender receives a refund of his cryptocurrency asset. This explicit type of transaction is referred to as a smart contract, whereas the terms of the transaction are distributed in a decentralized blockchain node network (learn more about nodes and DeFi structures in one of our last articles here: https://blocksize-capital.com/defi-boomtime/).

The function and benefits of smart contracts

Now that we have described the difference between Ethereum and Bitcoin, as well as how smart contracts play a key role in the structure of the Ethereum blockchain, we can proceed with a closer look at the different typologies of smart contracts, while also highlighting the benefits of the application and usage of such smart contracts in terms of financial services and the future of the fintech world.

On top of enabling parties to transact anonymously, there are certain benefits we can point out with regard to the implementation and usage of smart contracts in general:

“Transparency

Because there’s no third party involved, and because encrypted records of transactions are shared across participants, there’s no need to question whether information has been altered for personal benefit.

Security

Blockchain transaction records are encrypted, which makes them very hard to hack. Moreover, because each record is connected to the previous and subsequent records on a distributed ledger, hackers would have to alter the entire chain to change a single record.

Savings

Smart contracts remove the need for intermediaries to handle transactions and, by extension, their associated time delays and fees.”²

Regarding the different applications of smart contracts, there are three main types:

1. Smart legal contracts

Smart legal contracts facilitate legal processes in terms of the strict adherence to the legislation, with practical application in instances like real estate market contracts and international trade.

2. DAOs (decentralized autonomous organizations)

DAOs make use of smart contracts in order to introduce community regulations the participants have to abide by. A common example would be crowdfunding platforms. To learn more about the definition of DAOs and their structure, make sure you take a glance at our last article here.

3. Application logic contracts (ALCs)

These types of contracts are application-specific codes and have the ability to work in conjunction with other modules in order to be combined with regard to their functionality. ALCs represent an essential part of any multi-functional smart contract.

Furthermore, smart contracts currently power the buying and selling of ownership certificates of digital art, music, videos or NFTs (non-fungible tokens).

Smart contracts disrupting financial services

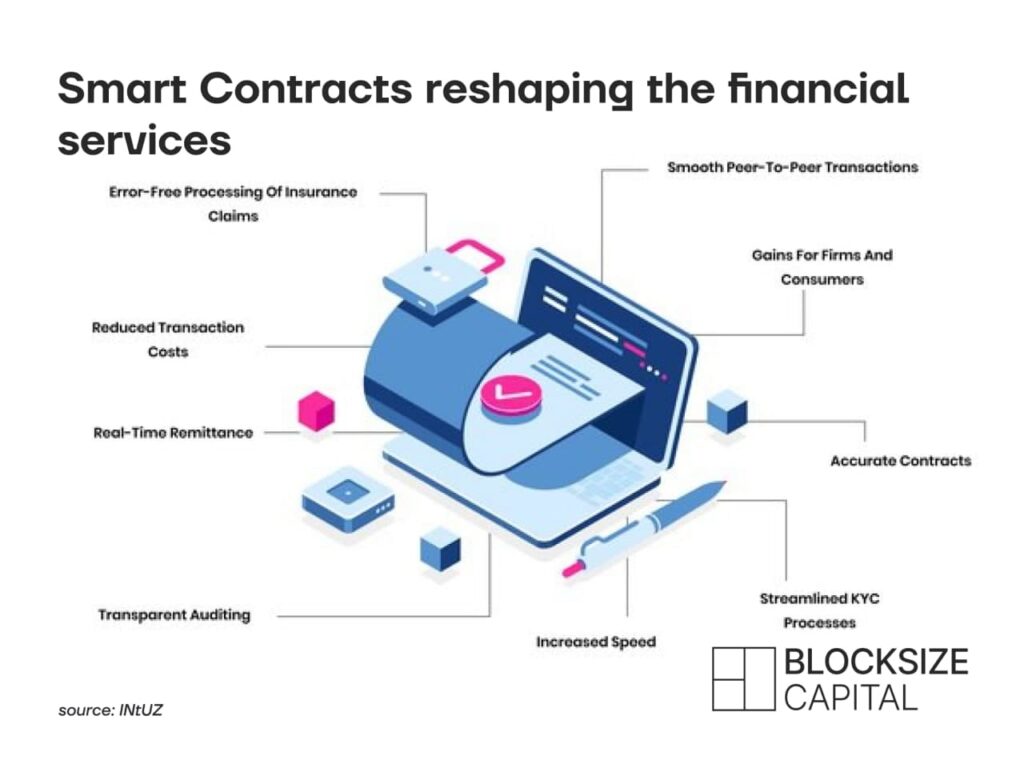

To sum up, smart contracts are not only qualified to disrupt the world of finance, the process is already ongoing and here is why:

With the use of smart contracts the cryptocurrency world is providing the basis for a global financial system, whereas an internet connection remains as the only barrier in order to participate and gain access to services and products of the future. In the absence of censorship and third-party validation, anyone can participate in the economy.

On the other hand smart contracts have the potential to automate manual banking processes (e.g.: evaluation of loan eligibility, compliance, claims-processing, etc.) and it’s nearly unthinkable to utilize financial services as we know them without smart contracts, especially in terms of peer-to-peer cryptocurrency transactions and also especially in comparison to traditional banking models.

Financial institutions willing to adopt the structure and implementation of smart contracts will benefit from minimized operational costs in the absence of the risk of human errors. Resulting in more transparency, those institutions can offer an up-to-date and satisfactory service to its clients.

On top of that the deployment of regulations by financial institutions can ensure more safety with a more manageable input.

Regardless of the scope of application, smart contracts can enable banks and other financial institutions to gain more insights about their customer’s behavior while at the same time providing a more efficient operational surface.

In general, we can expect an increase in the range of applications and the functionality of smart contracts itself in the future, with the potential to provide for a disruptive global financial system.

Blocksize Capital allows you to stay up to date with the most relevant developments in the world of fintech and cryptocurrencies, while at the same time providing a reliable and data-driven SaaS solution that helps you enter the digital asset market with full confidence and all the right tools at hand. Get in touch with us now, and let us help you pick the right solution for trading and managing your digital assets.

Sources:

¹ https://docs.ethhub.io/ethereum-basics/what-is-ethereum/#what-are-smart-contracts-and-decentralized-applications

² https://www.businessofapps.com/insights/how-smart-contracts-are-transforming-banks-and-financial-institutions/